Executive Summary

Through the Good Government Hotline, the County Auditor's Office received a report regarding All Good Northwest (AGNW), a provider under contract with the Joint Office of Homeless Services (Joint Office) to provide emergency shelter to community members. Through our investigation, we identified waste of government resources due to inadequate oversight by the Joint Office. For example, the Joint Office had approved more than $525,000 in unallowable costs due to ineffective contract management. Our investigation caught these unallowable costs, and we notified management, who then worked with AGNW to make corrections. The county ultimately recouped the costs.

AGNW provides alternative shelter for people experiencing houselessness. At the time of this report, all of AGNW's funding has come from the county, which indicates that the Joint Office should have been more closely monitoring AGNW's invoicing from the beginning. We identified that the Joint Office knew AGNW was new and was 100% reliant on county funding, but did not provide the level of fiscal monitoring/oversight that is essential in these circumstances.

Our investigation, based on a hotline tip, identified over $525,000 in unallowable costs that the Joint Office had approved. Contracting services to providers is a significant part of what the Joint Office does. In fiscal year 2023, contracted services for the Joint Office are budgeted to be $182 million,^ nearly 70% of the Joint Office's total expenditures for the year. The Joint Office must improve its fiscal oversight and contract monitoring to prevent future waste of limited government resources.

^ Based on the County's FY2023 adopted budget.

Investigation Results

Through the investigation, we identified waste of county resources due to inadequate oversight. In particular, we found ineffective contract monitoring that resulted in unallowable costs being approved by the Joint Office.

Type of Unallowable Cost & Amount

Overbilling*: $331,553

Unallowable Indirect Expense**: $193,675

Total: $525,228

* Based on our review of AGNW's approved February 28, 2022 invoice compared to AGNW's general ledger details

** Indirect was first requested by AGNW on their March 31, 2022 invoice

Internal Control Deficiencies Led to Unallowable Costs Being Approved by the Joint Office

Overbillings

AGNW overbilled the county by over $330,000, primarily in personnel expenses, by duplicating payroll expenses for the same pay period over separate invoices. Joint Office management approved the invoices and paid AGNW, resulting in overpayment to AGNW.

After we notified AGNW and Joint Office management, AGNW made corrections through future invoices, so that the county could recoup the overpayment.

Joint Office finance staff did not identify that AGNW had billed for the same costs, including personnel costs, on more than one invoice. This is the result of inadequate monitoring in their internal control process. The Joint Office should have required detailed supporting documentation for the invoices and reviewed the documentation before deciding whether to approve the invoices. The county's frequency of reviews for detailed documentation should be based on the risk associated with the provider. Since AGNW was a newly created provider in 2021 and was 100% reliant on county funding, it is reasonable that the county would consider AGNW to be higher risk.

Unallowable Indirect Expenses

The Joint Office initially approved $193,675 of indirect expenses. The Joint Office incorrectly told AGNW that it could bill the county for indirect expenses. However, since 100% of AGNW's expenses, including administrative costs, were billed to and paid by the county directly, no additional indirect expenses existed. Billing for indirect costs was therefore unallowable. A more detailed invoice review process would have identified that AGNW was billing 100% of its expenditures to the county, and indirect expenses were not applicable. After we notified Joint Office management that they had incorrectly approved paying indirect expenses, the Joint Office stopped payment and worked with AGNW to get a corrected invoice processed.

County used Capacity Building Funds to Help Create AGNW

AGNW was essentially a county-funded start-up. It did not exist as an operational organization until the Joint Office contracted with it to operate alternative shelter programs. Because of this, it did not have any established funding or cash flow to support operations. It appears that AGNW's overbilling errors stemmed, at least in part, from cash flow issues within the organization due to its 100% reliance on county funding.

The county usually pays providers on a cost-reimbursement basis. As a new organization, AGNW had no established funds (for example, cash) to cover

costs as they came due, which would occur before being reimbursed by the county. To help alleviate the cash flow constraints, the county provided AGNW

funds based on one month of their initial budgeted expenditures. These funds were intended to serve as the needed cash that would allow AGNW to cover

costs as they came due. The cash ultimately serves as operating capital for AGNW and is cash held by AGNW with no specific constraints or repayment terms. In addition to providing the funds, the Joint Office also paid AGNW on a cost-reimbursement basis, per its contract with the county, for 100% of its operating costs.

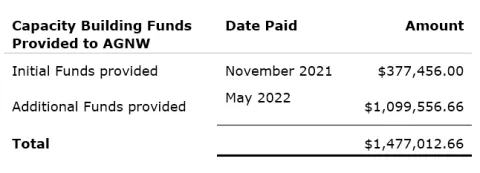

According to county staff and a September 2021 Joint Office memo outlining its capacity building program, the Joint Office agreed to pay $377,456 in capacity building funds to help AGNW with its cash flow needs. The Joint Office provided the funds in November 2021, about two months after AGNW operations began. The $377,456 of cash was apparently not enough to cover AGNW's operational costs (mostly personnel expenses) while waiting to invoice and be reimbursed by the county for those costs:

- As noted above, AGNW overbilled the county by more than $330,000. AGNW told us the double billing was the result of invoicing the county based on an estimate for incurred personnel costs in order to include the costs on the invoice, and get the invoice submitted as soon as possible so AGNW would have enough cash flow to pay employees. On the following invoice, with the payroll amounts booked, AGNW failed to back out the estimate that was include on the previous invoice.

- Two directors of AGNW made personal loans to AGNW. Although there is no prohibition for a director to provide a loan, this should have raised concern in the Joint Office about the organization's financial viability, and by extension, the organization's ability to continue to provide services on behalf of the county for the community.

- As a new organization, with no funding besides the county's, AGNW was in need of additional oversight and support from the Joint Office. Such additional oversight and support would likely have helped AGNW navigate this cash flow issue better.

Since we concluded our investigation, we learned that the Joint Office approved an additional $1.1 million in capacity-building funding for AGNW, bringing the total of capacity-building funding to nearly $1.5 million.

Under the terms of the September 2021 memo, AGNW was eligible to receive "an amount equal to one month of the initial annualized contract budget for new investments." In an update to that memo written to the county's Chief Financial Officer on April 18, 2022, just days after we notified Joint Office management of the unallowable costs, Joint Office management wrote that it was changing its policy to allow for the payment of up to two months of annualized contract expenses to providers. The memo also included the language: "The amount of each allocation will be determined based on the individual needs of the provider."

The Joint Office provided several other providers with capacity-building funding, but provided no other providers with capacity building funds to help establish a new organization's operations. It is unclear if the Joint Office made anyone else aware that such an opportunity existed.

Federal Funding Used, but No Required Risk Assessment Performed, & AGNW Not Notified of Federal Funding Requirements in their Contract with the County

The county's contracting policies require a fiscal compliance review if federal funding is used to fund a contract. It is the responsibility of a department (the Joint Office in this case) to let the county's Central Purchasing unit know if federal funding is involved. The Joint Office did use federal funding to cover some of AGNW's program expenditures, as we identified in our review of the invoices. However, a fiscal compliance review did not occur. This process did not occur because the Joint Office did not let the county's Central Purchasing unit know that federal funding would be used to pay AGNW. It is critical that a department identifies the potential for federal funding so that a fiscal compliance review is performed.

When a department identifies the potential for federal funding, the county's Fiscal Compliance unit completes a required risk assessment. The risk assessment would likely have identified the elevated risk of cash flow issues associated with AGNW, based on it being a brand new organization and its 100% reliance on funding from the county. This risk level would have led to additional language in the contract to help address the elevated risk, such as increased monitoring.

With the identification of federal funding, the contract would have included the appropriate language necessary for contracts that have federal funding. This is important, especially for new providers, as federal funding can trigger compliance regulations specific to the federal funding. The county should give providers as much advance notice as possible for these potential additional requirements.

Recommendations

The Auditor's Office recommends the following measures to the county and the Joint Office, to improve quality and accuracy in invoice processing, and to ensure accountability with regard to contract management:

- The county should not provide 100% funding to an organization, unless that organization goes through a risk assessment, no matter the funding source. For organizations the Joint Office may fund, the Joint Office should conduct the risk assessment and develop a plan to identify the appropriate level of support, funding, and oversight. The risk assessment and plan should be done in collaboration with the Chief Financial Officer's Fiscal Compliance unit.

- Based on the risk assessment results, the Joint Office should ensure contract language is added to ensure appropriate monitoring occurs. The Joint Office should do this in collaboration with the Chief Financial Officer's Central Purchasing unit.

- Detailed monitoring and review of invoices should occur on a regular basis by the Joint Office fiscal staff. The frequency of monitoring and review should be increased for all organizations identified as high-risk (which should include any new/start-up organizations) and be no less frequent than at least once every six months. The Joint Office's detailed review should include reviewing supporting documentation for amounts reported on invoices submitted. Examples can include requiring ledger details and comparing to invoice amounts reported and performing follow-up for specific details as deemed necessary.

- To help address any potential role conflicts, the Joint Office fiscal staff responsible for invoice review and monitoring should be separate and have independence from the Joint Office program staff responsible for advocating for and supporting providers.

About Hotline Investigations

A hotline investigation is not an audit. We follow our detailed procedures in the investigation of hotline tips, which include a preliminary review of the tip and an investigation when our preliminary review indicates it is necessary.

We follow all of the requirements of Oregon Revised Statute 297.765, Policies and Procedures for Local Government Waste Hotlines. Our compliance with ORS 297.765 requires us to determine in writing whether activities are occurring that constitute waste, inefficiency, or abuse. The statute allows us to include other pertinent information in our determination. When we determine that waste, efficiency, or abuse has occurred, we are to deliver our findings to the Board of County Commissioners.